Property Tax Exemption Delaware . delaware law offers complete property tax exemption for: homeowners age 65 or over are eligible for a tax credit against regular school property taxes of 50 percent (up to $400). Partial tax exemptions are available for some taxpayers. senior school property tax relief. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. application for senior school property tax credit to qualify for this credit, you must be age 65 or older. Those who are disabled or over 65 may be eligible,. Who qualifies for the new senior. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. Applicant must be at least 65 years of age prior to july 1 of the fiscal. new castle county senior tax exemption.

from www.sampleforms.com

the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. senior school property tax relief. Applicant must be at least 65 years of age prior to july 1 of the fiscal. homeowners age 65 or over are eligible for a tax credit against regular school property taxes of 50 percent (up to $400). Partial tax exemptions are available for some taxpayers. Those who are disabled or over 65 may be eligible,. application for senior school property tax credit to qualify for this credit, you must be age 65 or older. delaware law offers complete property tax exemption for: new castle county senior tax exemption.

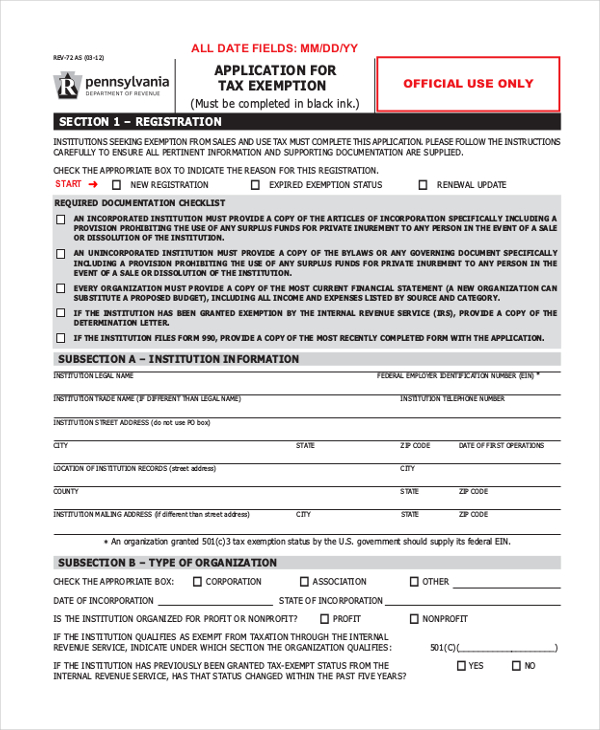

FREE 10+ Sample Tax Exemption Forms in PDF MS Word

Property Tax Exemption Delaware new castle county senior tax exemption. Those who are disabled or over 65 may be eligible,. homeowners age 65 or over are eligible for a tax credit against regular school property taxes of 50 percent (up to $400). Applicant must be at least 65 years of age prior to july 1 of the fiscal. senior school property tax relief. Who qualifies for the new senior. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. new castle county senior tax exemption. application for senior school property tax credit to qualify for this credit, you must be age 65 or older. delaware law offers complete property tax exemption for: In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. Partial tax exemptions are available for some taxpayers.

From www.pdffiller.com

Fillable Online Property Tax Exemption Worksheet 63602GG. Property Tax Property Tax Exemption Delaware homeowners age 65 or over are eligible for a tax credit against regular school property taxes of 50 percent (up to $400). Those who are disabled or over 65 may be eligible,. Partial tax exemptions are available for some taxpayers. senior school property tax relief. In order to receive an exemption, you must submit an application to the. Property Tax Exemption Delaware.

From www.formsbank.com

Fillable Application For Exemption From Erie County Real Property Taxes Property Tax Exemption Delaware Who qualifies for the new senior. Those who are disabled or over 65 may be eligible,. Partial tax exemptions are available for some taxpayers. application for senior school property tax credit to qualify for this credit, you must be age 65 or older. the city provides a property tax exemption up to $715.64 per year to homeowners aged. Property Tax Exemption Delaware.

From www.charlescitypress.com

Senior homeowners urged to apply for new property tax exemption before Property Tax Exemption Delaware Partial tax exemptions are available for some taxpayers. senior school property tax relief. Who qualifies for the new senior. application for senior school property tax credit to qualify for this credit, you must be age 65 or older. Those who are disabled or over 65 may be eligible,. Applicant must be at least 65 years of age prior. Property Tax Exemption Delaware.

From www.pdffiller.com

Annual Property Tax Exempt Short Doc Template pdfFiller Property Tax Exemption Delaware senior school property tax relief. new castle county senior tax exemption. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. delaware law offers complete property tax exemption for: Applicant must be at least 65 years of age prior to july 1 of the fiscal. Who qualifies for. Property Tax Exemption Delaware.

From www.bendoregon.gov

Property Tax Exemption City of Bend Property Tax Exemption Delaware Applicant must be at least 65 years of age prior to july 1 of the fiscal. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. homeowners age 65 or over are eligible for a tax credit against regular school property taxes of 50 percent. Property Tax Exemption Delaware.

From www.exemptform.com

Homeowners Exemption Cook County Form 2023 Property Tax Exemption Delaware In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. Applicant must be at least 65 years of age prior to july 1 of the fiscal. new castle county senior tax exemption. senior school property tax relief. delaware law offers complete property tax exemption for: Partial tax exemptions. Property Tax Exemption Delaware.

From nonprofitquarterly.org

In Delaware, Nonprofit Does Not Mean PropertyTaxExempt Non Profit Property Tax Exemption Delaware Those who are disabled or over 65 may be eligible,. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. new castle county senior tax exemption. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st.. Property Tax Exemption Delaware.

From www.formsbank.com

Long Form Property Tax Exemption For Seniors printable pdf download Property Tax Exemption Delaware Applicant must be at least 65 years of age prior to july 1 of the fiscal. Partial tax exemptions are available for some taxpayers. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. new castle county senior tax exemption. senior school property tax relief. application for senior. Property Tax Exemption Delaware.

From www.formsbank.com

Fillable Form 5403 Real Estate Tax Return Declarationof Estimated Property Tax Exemption Delaware the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. senior school property tax relief. new castle county senior tax exemption. delaware law offers complete property tax exemption for: homeowners age 65 or over are eligible for a tax credit against regular. Property Tax Exemption Delaware.

From www.formsbank.com

Fillable Long Form Property Tax Exemption For Seniors printable pdf Property Tax Exemption Delaware the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. delaware law offers complete property tax exemption for: In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. Partial tax exemptions are available for some taxpayers.. Property Tax Exemption Delaware.

From www.templateroller.com

Delaware Application for Forest Land Tax Exemption Fill Out, Sign Property Tax Exemption Delaware Those who are disabled or over 65 may be eligible,. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. application for senior school property tax credit to qualify for this credit, you must be age 65 or older. the city provides a property tax exemption up to $715.64. Property Tax Exemption Delaware.

From www.scribd.com

Property Tax Exemption Form Nonprofit Organization Tax Exemption Property Tax Exemption Delaware homeowners age 65 or over are eligible for a tax credit against regular school property taxes of 50 percent (up to $400). Applicant must be at least 65 years of age prior to july 1 of the fiscal. delaware law offers complete property tax exemption for: Those who are disabled or over 65 may be eligible,. new. Property Tax Exemption Delaware.

From www.formsbank.com

Residential Property Tax Exemption Municipality Of Anchorage Property Tax Exemption Delaware Partial tax exemptions are available for some taxpayers. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. Applicant must be at least 65 years of age prior to july 1 of the fiscal. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65. Property Tax Exemption Delaware.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Property Tax Exemption Delaware Those who are disabled or over 65 may be eligible,. senior school property tax relief. Who qualifies for the new senior. Partial tax exemptions are available for some taxpayers. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. application for senior school property tax credit to qualify for. Property Tax Exemption Delaware.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Property Tax Exemption Delaware Applicant must be at least 65 years of age prior to july 1 of the fiscal. Those who are disabled or over 65 may be eligible,. Who qualifies for the new senior. senior school property tax relief. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based. Property Tax Exemption Delaware.

From www.formsbank.com

Application For Homestead Property Tax Exemption Form printable pdf Property Tax Exemption Delaware Applicant must be at least 65 years of age prior to july 1 of the fiscal. In order to receive an exemption, you must submit an application to the county’s assessment division by june 1st. Partial tax exemptions are available for some taxpayers. new castle county senior tax exemption. homeowners age 65 or over are eligible for a. Property Tax Exemption Delaware.

From www.townofantigonish.ca

Low Property Tax Exemption Town News Property Tax Exemption Delaware the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. Applicant must be at least 65 years of age prior to july 1 of the fiscal. application for senior school property tax credit to qualify for this credit, you must be age 65 or older.. Property Tax Exemption Delaware.

From www.taxuni.com

Delaware Property Tax 2023 2024 Property Tax Exemption Delaware Applicant must be at least 65 years of age prior to july 1 of the fiscal. the city provides a property tax exemption up to $715.64 per year to homeowners aged 65 and over who qualify based on income. delaware law offers complete property tax exemption for: Partial tax exemptions are available for some taxpayers. new castle. Property Tax Exemption Delaware.